The Reserve Bank of India (RBI) on Friday announced that Rs 2,000 notes will only stay on as legal tender, and it would be discontinued from circulation. About 89% of the Rs 2000 denomination banknotes were issued prior to March 2017 and are at the end of their estimated life-span of 4 to 5 years, the RBI said in a notification.

Here are my key takeaways on this decision:

1) Can it be a legal tender?

The decision to withdraw the Rs 2000 denomination banknotes from circulation was taken under the RBI’s ‘Clean Note Policy’. However, they will continue as legal tender. This is both confusing and impractical. How can a currency that is withdrawn still continue be a legal tender? People have been asked to exchange it by September 30th. If it were only reduced like it was in year 2019, it could not be called demonitisation as acceptance wasn’t illegal. However, if a currency isn’t existing then the question of it being legal or illegal doesn’t exist. It’s simply void. Thus, although the government or RBI hasn’t claimed it is demonitisation theoretically in the literal sense, it is practically demonitisation.

2) Was it a falling currency?

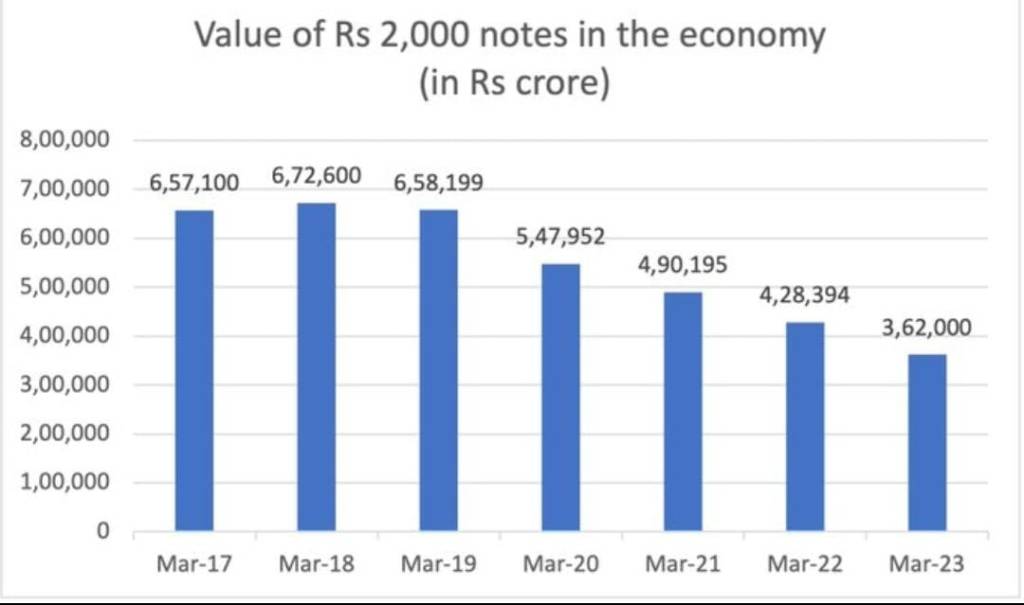

Rs 2,000 denomination banknotes were not commonly used for transactions. The use of these notes declined from Rs 6.73 lakh crore on March 31, 2018 (37.3% of Notes in Circulation) to Rs 3.62 lakh crore constituting only 10.8% of notes in Circulation on March 31, 2023.

In a couple of years they would be down to less than 5%. There was really no need to do this unless the idea was to destabilise others politically.

3) Rs.2000 was not a popular medium of exchange

Notes of other denominations are adequate to meet the currency requirements of the public. In any case, Rs. 2000 failing as a currency isn’t something surprising.

What would do with Rs.2000 note in market, when you hardly get change for Rs.500? Especially in current times when liquid cash is failing. This led to adverse effects in consumption behaviour and consumption pattern. Not everyone has any business to do in a local grocery store with Rs. 2000 notes in his/her pocket. Firstly, shopkeeper won’t give exchange. Secondly, on an average day, an average middle class person will take Rs. 500 in a store. Unless one has too buy goods in stock, Rs. 2000 serves no use.

Majority of the people in the country would prefer weekly purchase over monthly. Geographical reasons, storage issues, fear of food spoilage are reasons. Things that are required more like rice or mustard oil or dal are items one purchases monthly. In this case, Rs. 2000 would be of use. Another section of the country that is the lower class comprising daily wage labourers or maids do daily purchase of vegetables and other essentials however little. In this case, Rs. 100 would be of use.

Let’s understand it by an example of a typical middle-middle class family. Let’s assume they do a mixture of monthly purchase and weekly purchase. Exclude rice, dal in weekly purchase, and keep it for monthly purchase. Consider fruits, butter, biscuit, flattened rice, snacks, diet chera as products of weekly purchase. Here, Rs. 500 notes would be used. Monthly purchase consisting of rice, dal, mustard oil, white oil, medicines, tea leaves would require Rs. 2000 notes.

4) Productivity loss

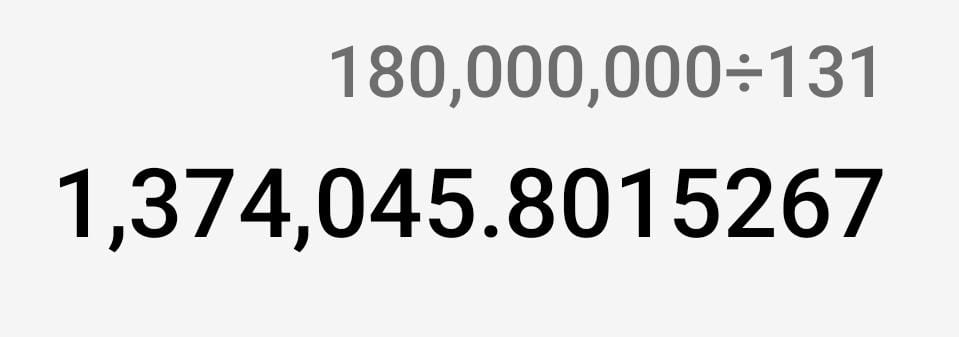

Rs 3,62 lakh crore of notes were still out there in the financial system as of March 2023. At one time notes worth Rs 20,000 can be exchanged. In order to exchange all the Rs 2,000 notes out there, 18.1 crore visits to the banks will have to be carried out. This is going to be a hard activity for everyone be it RBI officials or citizens themselves. It will effect the productivity of the country. Time wastage and frankly speaking wastage of efforts too.

Let’s understand this by a hypothetical calculation. Round off 18.1 crore to 18 crore. From today 22nd May, 2023 if we count, 131 days are there for exchange. That would account for 13 lakh citizens standing in queue everyday for an average of 3 hours (including transport time).

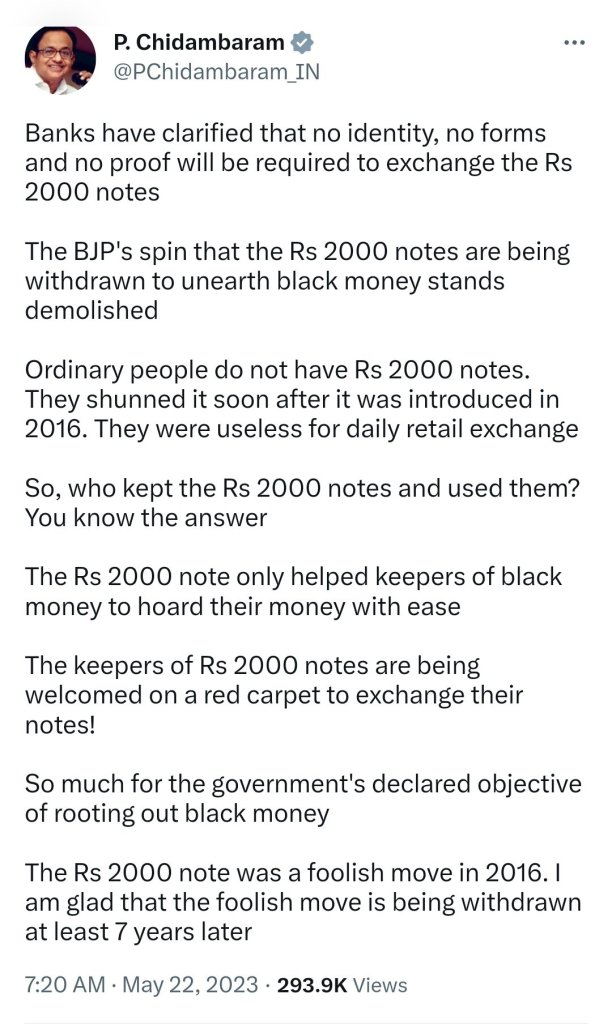

5) The issue of corruption and hoarding

2016 demonitisation was a failure. It’s a fact. Experts of different fields law, economics etc; have also acknowledged the same. The idea was to remove corruption. Corruption has increased with fleeing country being a new method. Have Nirav Modi, Vijay Mallya come back? No. We have new names in list, Mehul Choksi , Lalit Modi. There’s any evidence suggesting black money hoarding has reduced or crony capitalism has been kept in check. Thus, repeating the same old idea by only making theoretical changes makes no sense.

The Rs 2000 notes were also used widely by the fake currency mafia. Most of the fake money seized in the last three years was in the Rs 2000 denominations, according to a report by Business Standard. In 2021, fake Rs 2000 notes whose value was Rs 4,84,78,000 crore were seized. Around 2,44,834 lakh fake notes of Rs 2,000 were seized in 2020 and 90,566,000 notes in 2019.

6) The issue of counterfeiting

Since the printing of the notes stopped in 2019, they would have gone out of circulation. But it could be a way to expose those hoarding black money. They are bound to get exposed if they go to deposit large sums in the bank. The exchange for money in the first place or even deficit financing (printing of new money) has been proven to be economically inefficient multiple times.

Let’s understand the mathematical logic behind this. To replace the quantity of Rs.2000 notes with Rs.500 notes, RBI only needs to print 85,860 lakh pieces Rs.500 notes. In 2021-22, RBI printed 1,28,003 lakh pieces of Rs.500 currency. RBI has the capacity to print & supply around 2,22,500 lakh notes every year. How many counterfeit 2000 notes were detected by the RBI and banks since 2016? 79836 number of 2000 notes, ie, amounting to Rs. 15.97 crores.

Counterfiets of that Rs.1000 notes in 2017 were just 2.4 pieces/crore notes. So Rs.2000/- facilitated more counterfeits, almost 27 times of Rs.1000 notes. Same time, the number of Rs.500 counterfeits in 2022 was just 17.5 nos./crore in comparison with 64 nos./crore of Rs.2000 notes.

Data reveals that though the Rs.2000 notes are the highest, the counterfeit currency is a tiny fraction of Rs. 31,05,721 crores of CIC. Thus, RBI could have easily absorb the 2000 currency notes in circulation and replace it by 500 notes.

Besides, high value currency facilitates hoarding at ease than low value currency. A 100% counterfeit proof note cannot be made either. You don’t need to have an economics degree to understand that. It’s a fact.

Nothing can happen unless economic reforms take place to increase liquid cash in a middle class household. Besides better enforcement and replacement of currency without creating panic among people are sound practices adopted world over against the menace of corruption.

Thank you for reading For more such interesting write ups and political analysis, do follow me here or on Twitter. My social links are given below for more such freshly brewed content. 🙂

Disclaimer

Any views or opinions represented in this blog are personal and belong solely to the blog owner and do not represent those of people, institutions or organizations that the owner may or may not be associated with in professional or personal capacity, unless explicitly stated. The views or opinions are not intended to malign any religion, ethnic group, club, organization, company, or individual. All content provided on this blog is for informational purposes only. The owner will not be liable for any errors or omissions in this information nor for the availability of this information. The owner will not be liable for any losses, injuries, or damages from the display or use of this information. The blog owner is not responsible for the content in comments. This blog disclaimer is subject to change at any time.